News from the network

The following section contains news regarding events, activities, cultural exchanges and other news relevant for businesses in Denmark.

Sign up for our newsletter

Sign up for our newsletter and be updated for the last news.

- Latest

- Members News

- UK & DK news for the network

- BREXIT

- Event Reports

- BCC

Contact us

Do you have any questions, please contact us.

Please contact us for questions

We will respond to your inquiry as quickly as possible. We will gladly answer any questions regarding:

- Our organisation

- Memberships and upcoming events

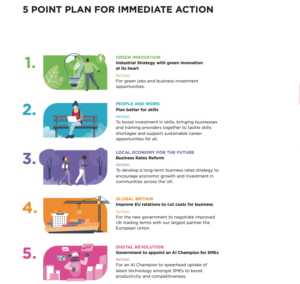

GREEN INNOVATION Industrial Strategy with green innovation at its heart Action For green jobs and business investment opportunities. PEOPLE AND WORK Plan better for skills Action To boost investment in skills, bringing businesses and training providers together to tackle skills shortages and support sustainable career opportunities for all. LOCAL ECONOMY FOR THE FUTURE Business Rates Reform Action To develop a long-term business rates strategy to encourage economic growth and investment in communities across the UK. GLOBAL BRITAIN Improve EU relations to cut costs for business Action For the new government to negotiate improved UK trading terms with our largest partner the European Union. DIGITAL REVOLUTION Government to appoint an AI Champion for SMEs Action For an AI Champion to spearhead uptake of latest technology amongst SMEs to boost productivity and competitiveness.row_forward

GREEN INNOVATION Industrial Strategy with green innovation at its heart Action For green jobs and business investment opportunities. PEOPLE AND WORK Plan better for skills Action To boost investment in skills, bringing businesses and training providers together to tackle skills shortages and support sustainable career opportunities for all. LOCAL ECONOMY FOR THE FUTURE Business Rates Reform Action To develop a long-term business rates strategy to encourage economic growth and investment in communities across the UK. GLOBAL BRITAIN Improve EU relations to cut costs for business Action For the new government to negotiate improved UK trading terms with our largest partner the European Union. DIGITAL REVOLUTION Government to appoint an AI Champion for SMEs Action For an AI Champion to spearhead uptake of latest technology amongst SMEs to boost productivity and competitiveness.row_forward